We are excited to announce our new partnership with Joe Floyd and Emergence Capital, and the Series-A funding that will accelerate our innovation and growth as the leading retail data platform.

Here are a few thoughts and observations that provide context for the next phase of growth at SoundCommerce.

The Commerce Opportunity

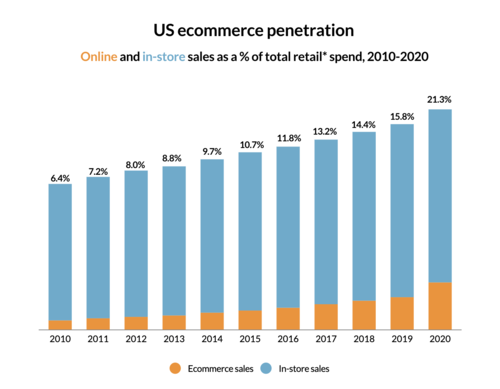

According to DigitalCommerce360, U.S. consumers spent $861.12 billion online in 2020, up an incredible 44.0% year over year. That translates to an additional $174.87 billion in ecommerce revenue, and the highest annual U.S. ecommerce growth in at least two decades.

US ecommerce will easily exceed $1T in 2021.

Online’s share of total retail sales has steadily been on the rise — with ecommerce penetration hitting 21.3% in 2020, up from 15.8% in 2019, and 14.3% in 2018. The 5%+ point gain in ecommerce penetration in 2020 is the biggest year-over-year jump for U.S. retail sales ever recorded.

For both emerging pure plays and established at-scale omnichannel brands, the consumer-direct (DTC) commerce model is simultaneously the primary existential threat and opportunity.

Independent Brands Lead While Amazon Lags

Tucked below the fold in this recent 2020 retail industry performance recap, is the news that Amazon’s 38% growth last year, while astounding, lagged behind the 44% growth of the ecommerce industry at large:

This means sales on Amazon alone represented nearly a third—31.4%—of all U.S. ecommerce sales growth in 2020. That’s certainly a significant share of online sales growth, and one we’re familiar with when it comes to the ecommerce giant, but there’s more to the story. The 31.4% is down from Amazon’s 43.8% share in 2019. This is likely a sign of the gains made by other big competitors in 2020.

So as the pace of ecommerce growth tripled year over year, Amazon for the first time (ever?) fell behind competitors in share of industry growth as other major retailers grew their online sales by more than 85% in 2020

Growing Demand & Opportunities for Owned-Commerce Brands

While Amazon’s growth may be decelerating (at least relative to industry comps), the company’s total GMV represents half of total ecommerce sales in North America. The other half consists of “owned commerce” transactions flowing through independent sellers running on platforms like Shopify, Salesforce Commerce Cloud, and BigCommerce alongside thousands of unique SaaS commerce-enablement tools.

Our thesis at SoundCommerce includes three important perspectives regarding this bifurcated market:

1. Owned-commerce is where sustainable value creation occurs for brands and retailers

For emerging brands today, Amazon marketplace and owned commerce channels are almost polar opposites in terms of execution and upside.

Amazon represents a relatively easy path to transaction volume, but a strategic capitulation given that Amazon owns the shopper relationship and the enterprise value creation that comes with that strategic asset.

DTC brands understand how customer equity has become the new yardstick for retail enterprise value — one with 10X value creation opportunity. For the same reason that every wholesale manufacturer is moving toward the consumer direct model, Amazon may be one of many channels in a broader omnichannel strategy, but it cannot be the only one.

2. Owned-commerce is exceptionally hard, especially in terms of viable unit economics (marginal profitability) and CLV

In the face of volatile variable costs in held-inventory COGS, digital marketing and doorstep delivery, consumer brands that pursue the owned-commerce DTC model (and traditional omnichannel retailers for that matter) take on enormous operational complexity and financial risk. The payoff of executing well is the creation of a strategic asset in the form of a captive customer base with high brand loyalty and propensity to re-engage reflected in growing customer lifetime value (CLV).

3. Data capability (first) and data-driven operational discipline (next) differentiate winners from losers

Direct-to-consumer commerce exploded in 2020 with the help of COVID tailwinds.

While brand, product and marketing are fundamental to the DTC model (see Brand, Do You Even Disrupt?!), profitable scaling requires both deep data capability and disciplined operations that align with unit-level contribution margin and customer lifetime value (CLV).

Amazon does not control 50% of the US ecommerce TAM because they out-market the competition. To the contrary, their unfair advantage involves real-time and predictive optimizations across a staggeringly complex distributed operational footprint.

We believe that the market is now revealing how investments in data and operations are producing results for independent brands and retailers as they grow faster than Amazon TTM.

OLG FTW!

This notion of “operations-led growth” for consumer brands and retailers drives our work and technology innovation at Sound.

- Data is a key differentiator among brands, but only when brands leverage data in an intentional and disciplined way that spans systems, departments, partners, and locations.

- Given the importance of positive contribution margin over the lifetime of each customer, brands must instrument for profit-based decisioning across all aspects of the business, especially post-conversion customer experience driven by retail operations.

- The stakes are huge, as brands that own the customer relationship and can quantify the value of their customer equity stand to benefit from valuations that exceed industry peers by orders of magnitude.

A Footnote on Headless Commerce

During our capital raise process, prospective investors sometimes had difficulty understanding the distinction between SoundCommerce as a data cloud accelerator for the retail vertical and “headless commerce” providers like Shogun and Nacelle.

Thousands of best-of-breed SaaS providers are tackling the departmental and functional needs for operational software applications. We see no market need compelling us to compete in that SaaS ecosystem.

The most obvious difference between Sound and headless commerce providers is our role in productizing and accelerating our customer’s path to a comprehensive data warehouse (or more technically, streaming analytical data warehouses like Snowflake and Google BigQuery) for the purpose of elevating real-time and predictive decisions to align with strategic metrics like contribution profit and customer lifetime value (CLV).

SoundCommerce is directly unlocking the strategic value of the modern data cloud for retail brands.