A 9-Part Guide to the Core Business Models Driving D2C Brands.

PARTS 4, 5 and 6.

It turns out there are only nine business model variants we’ve observed in the wild which allow a D2C brand to successfully engage consumers, disrupt incumbents, and change the world. In the lead up to ShopTalk March 3 in Las Vegas, we’re reviewing them all here.

Great D2C brands view their entire existential purpose through the lens of lifetime customer experience, measured as customer equity. Creating unique customer experience is the key to building enterprise value.

Last month we reviewed the first three of these D2C models — focusing on efficiency and price disruption, product differentiation, and brand social impact.

This time, let’s dig into network effects, subscription models, and brand exclusivity. Here we go!

4. Tap the Network

It’s easy to think of brand ambassadors, influencer networks, social media, and user generated content as marketing concerns. This is where traditional brands miss the point and the mark.

Brands scale when when customers use — and share — products naturally aligned (if not purpose built) for photo and video consumption, and ambassador / influencer network effects.

This starts with product design, considering how a product might connect to the cloud, integrate with an app, or facilitate enthusiast collaboration. A great example is the launch strategy employed by brands like Coolest and Baubax, which funded (with $13M and $9M, respectively) and launched on Kickstarter, engaging millions of customers in the product validation process.

No better way to confirm product-market fit than getting shoppers to pay for the product before you’ve even built it yet.

5. Increase Convenience

Beyond brand authenticity and distinctive product, certain models are best suited for the unit economics of direct-to-consumer commerce. A great way to increase customer equity is to increase purchase frequency. Replenishment and new product-discovery subscriptions are an important part of this balanced D2C breakfast.

Subscription models require either a consumable (e.g. razor blades) or the assortment breadth to support product cross sells. Retailers like StitchFix and TrunkClub (now a Nordstrom program) apply predictive modeling to personalize the assortment in every order, while brands like Black Rifle Coffee and Graze rely on consumables to drive repeat engagement.

Check out Lovevery for an example of a brand that ships a different product assortment every month, tailored to a child’s age-appropriate learning development needs.

6. Engineer Exclusivity

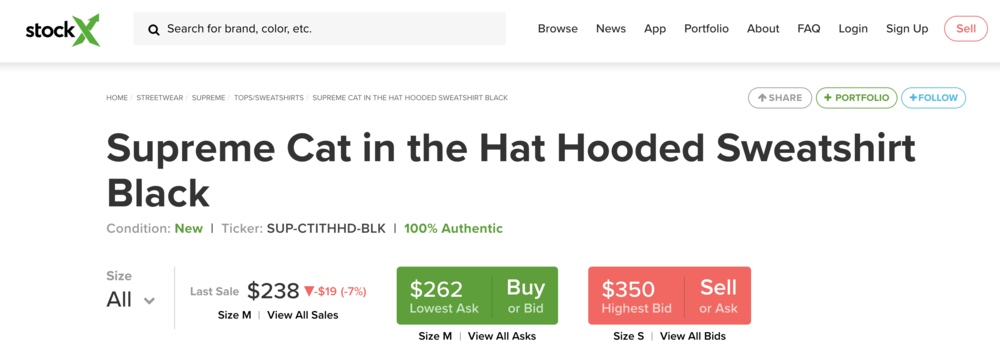

High-growth D2C fashion brands like Supreme and Palace have taken a page from footwear and fast-fashion, and evolved it. They employ product drops to manufacture scarcity and drive brand exclusivity.

No surprise that Supreme’s ecommerce storefront is closed for business except during seasonal drops. An entire secondary market has emerged to capitalize on consumer demand for these limited edition products, from HypeBeast marketplace to SuperCop shopping bots.

This is about always having something new to promote to the customer, and in limited quantities to over-index demand against supply. The model complexity lies in the speed of product design, production, and sourcing; the online and offline scaling requirements driven by each drop; the policing of counterfeit and illicit aftermarket trade (blockchain!); and knowing what to promote next in the role of fashion tastemaker.

For Review

In case you missed it, check out our original post on D2C brand disruption and models 1-3.

Next Up

Finish strong with our third and final installment in the SoundCommerce Guide to D2C Brand Disruption!