A 9-Part Guide to the Core Business Models Driving D2C Brands.

Until you, the disruptive DTC market, tell us otherwise, this is our final installment in The SoundCommerce Guide to Core Business Models Driving D2C Brands. (Yeah, it’s an SEO mouthful).

It turns out there are only eight (wait, nine!) business model variants that allow a D2C brand to successfully engage consumers, disrupt incumbents, and change the world.

Our initial post introduced the first three of these D2C models — focusing on (1) efficiency and price disruption, (2) product differentiation, and (3) brand social impact. Episode II dug into (4) network effects beyond digital marketing, (5) subscription models, and (6) brand exclusivity.

We wrap up the series here with a look at (7) the importance of halo or hero products that drive brand awareness and single-purchase customer LTV (also known as LCV), and (8) the power of (very retailer-like) product selection and cross-sell opportunities. Bonus! We’re including (9) a critical strategy in the mix — one often confused in the industry with regard to retailing and pure-play ecommerce models.

Without further ado then, our final three disruptive DTC strategies:

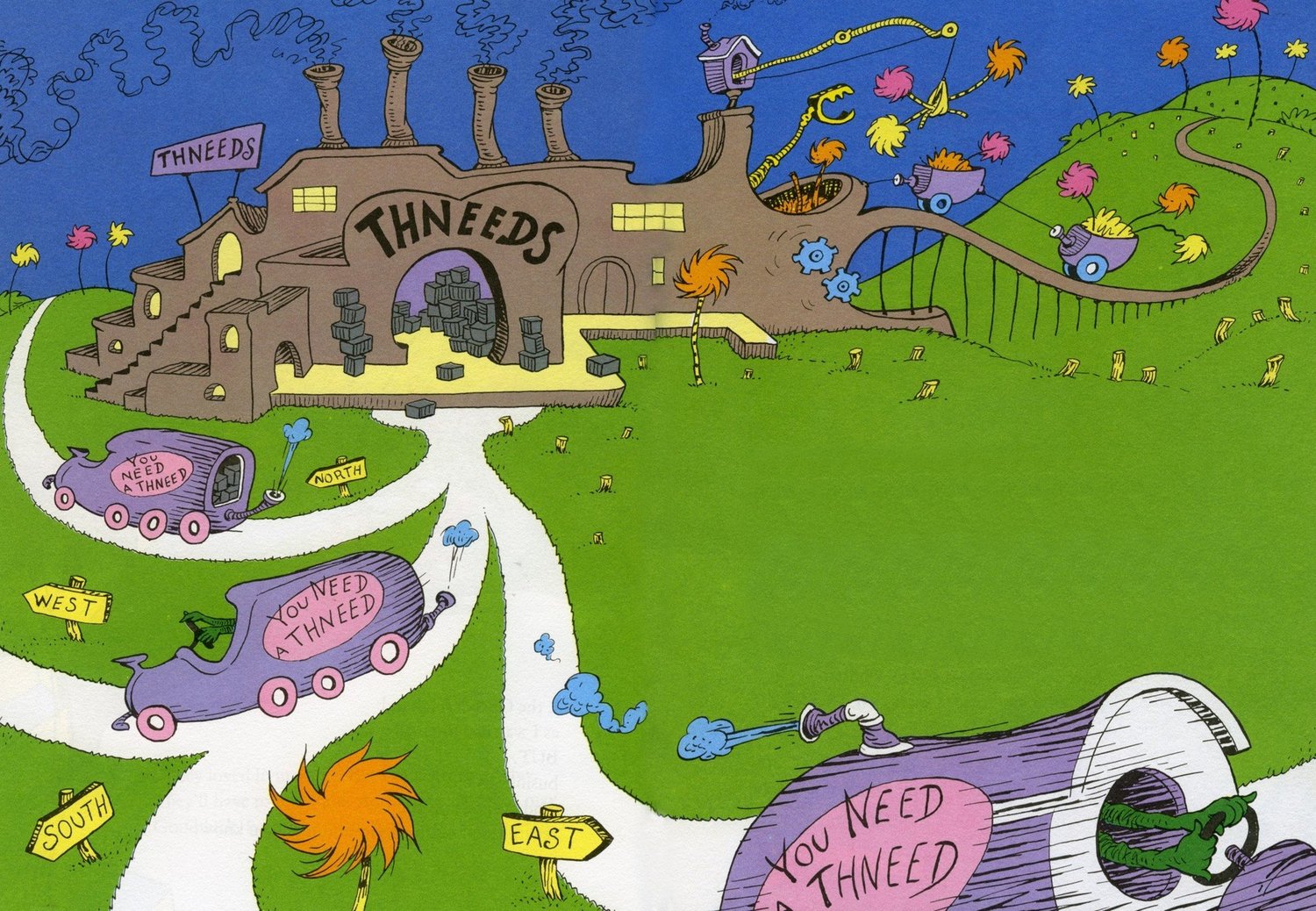

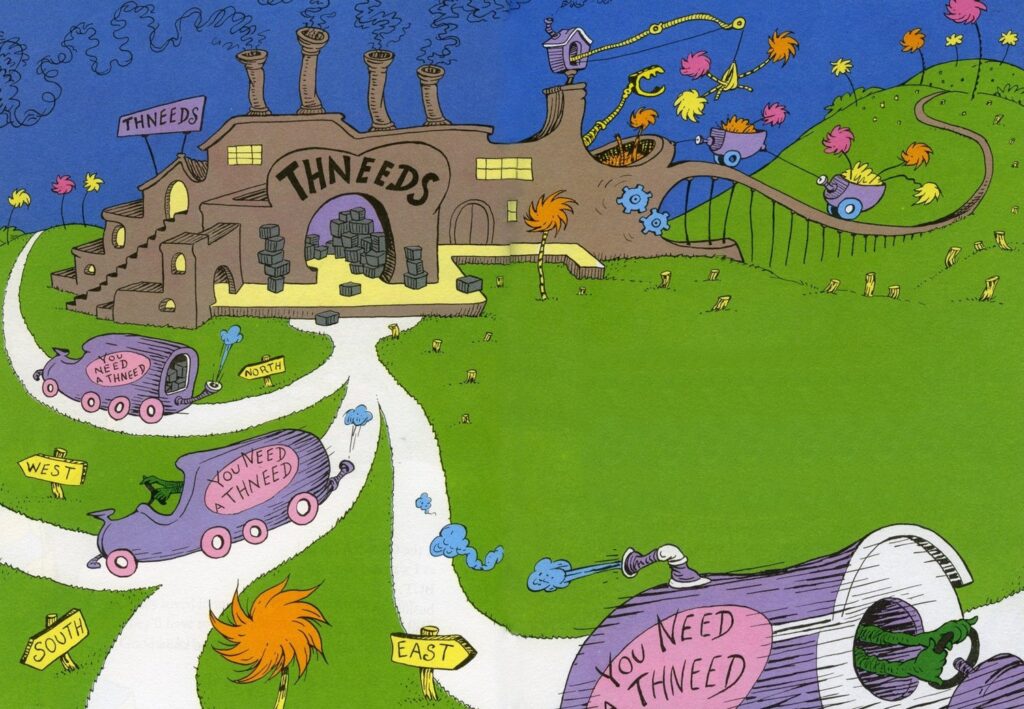

7. Hawk High-Ticket Halos

For this strategy, we refer back to our reference in the original post — the one-time, single-purchase model that works (at least in theory) even if customers never come back. The viable exception to frequency as an LTV driver is when first order monetary value, M, contains a statement SKU or disruptive hero (like a Casper queen mattress at $995) that generates sufficient revenue and margin alone to justify the product, acquisition, fulfillment, and service costs of the order. No future purchase is necessary to achieve target gross margin return on investment.

“Even if your brand benefits from an incredible price point and unit economics, there is value in offering downstream goods and services that build consumer relationships.“

The problem here is that brands aren’t built on one-time consumer engagement. Even if your brand benefits from an incredible price point and unit economics, there is value in offering downstream goods and services that build consumer relationships.

Today, Casper sells everything from bedding, nightstands, and lighting to dog beds, pillows, and bed frames.

8. Source Assortment

Retailers hold an inherent advantage over direct-to-consumer manufacturers. They source and sell large catalogs with long tails of products available for upsell and cross-sell. Here, the model drives LCV and customer equity by blending the M (Monetary Value, synonymous with Average Order Value or AOV) with R and F (Recency and Frequency). More products means a fuller cart each purchase, and more reasons to purchase more often. Cross-promotion requires assortment, which drives brands to expand from core categories into new.

This can be a private-label extension of manufactured goods. There’s a reason that cross-brand collaborations promoting MYBRAND X YOURBRAND proliferate. Partnering with complementary brands in complementary categories provides both brand marketing advantage as well as AOV growth.

“Partnering with complementary brands in complementary categories provides both brand marketing advantage as well as AOV growth.”

A more direct path is to source product directly from third-party suppliers. Generally, there are three approaches here that retailers know well. (1) You can stock the inventory, effectively expanding into wholesale inventory buys. Or you can open a (2) seller marketplace or (3) dropship supplier network. Under these models, the partner brand holds the goods until your orders convert and trigger their fulfillment workflow.

Who knew that Gap Inc. sold so many 3P brands?! But it makes sense. Assortment expansion helps drive AOV, purchase frequency and recency.

You may already be listing your products through JOOR and NuORDER. You can source complementary brands here too. Marketplace companies like Mirakl can help you set up a marketplace for 3P sellers. Platforms like DropShip Commerce, Logicbroker, and CommerceHub automate dropship transactions. And there’s a growing number of prepackaged supplier networks available from all-in-one programs like Oberlo and Doba.com.

“The risk of brand and category expansion is brand dilution.”

The risk of brand and category expansion is brand dilution. Additional complexity exists here in tracking cross-sell behaviors, figuring out who buys what with what, and what to promote next. Further, whenever inventory and order fulfillment responsibility are split across partners and distribution centers, it becomes much harder to control the customer journey and doorstep customer experience.

9. Stand Up Showrooms

Bonus strategy! Eight, it turns out, is not enough.

First, we need to address an industry-wide fallacy regarding the D2C/DTC model, that the label and concept are synonymous with ecommerce. This is not consistent with the strategy or reality of direct-to-consumer brands.

“D2C may start with a digital-first approach, but it’s never been just about selling online.“

D2C may start with a digital-first approach, but it’s never been just about selling online. The broader application of the phrase applies as brands eschew the wholesale channel and sell exclusively — at least to start — at retail pricing, direct to the consumer both online and in branded, private-label stores. Everlane, Madewell, and Allbirds brand stores are part of the D2C universe.

In order to scale, many pure-play D2C brands now also sell wholesale through the retailer channel, expanding beyond pure D2C. Casper sells through Target. Brands like AWAY and Allbirds now sell through “pop-in” stores within stores at Nordstrom. In a reversal of traditional roles, it’s the digitally native brands that create the consumer draw, pulling shoppers into the retailer’s stores.

“For direct-to-consumer brands, the role of owned brick and mortar stores is distinctly different than it was and is for retailers.”

For direct-to-consumer brands though, the role of “owned,” branded brick and mortar stores is distinctly different than it was and is for retailers. Corine Ruff has written an excellent summary of the differences.

Summarized, D2C brands view stores as a means to:

- Express brand values through distinct shopper experiences

- Provide shoppers a means to test and try (but not necessarily buy) products and services

- Directly gauge customer and prospect preferences and behavior

- Test new concepts, products, and programs… what Casper calls “playful science.”

- Carefully encourage customers to engage as brand ambassadors and influencers

None of these directly focus on conversion events and store inventory availability or velocity. That’s just not the point. Sales happen, but downstream in the form of a digital purchase and doorstep delivery.

How do you envision customers engaging with your products and brand?

How does that inform your strategy for the physical store experience?

Closing Thoughts — Where Do We Go From Here?

We stand by our assertion that direct-to-consumer brands are worth 10X their wholesale peers because, to paraphrase a famous wizard, they have something that wholesale brands do not. That something, of course, is shopper equity — a direct relationship with shoppers built upon distinct experiences, creating sustainable enterprise value.

“To paraphrase a famous wizard, D2C brands have something that wholesale brands do not: shopper equity.”

The goal of the D2C brand is to know and serve the customer so closely and so well, as to be able to predict the future of the relationship. The crucial step is to instrument the brand so that every decision from first touch to most recent delivery is measurable to named, individual customer LTV.

“When all is said and done, the market cap of your D2C brand is simply equal to your total customer equity.”

When all is said and done, the market cap of your D2C brand is simply equal to your total customer equity.

Contact us at SoundCommerce to profitably grow and create sustainable, outsized enterprise value for your brand.