A 9-Part Guide to the Core Business Models Driving D2C Brands.

PARTS 1, 2 and 3.

It turns out there are only nine business model variants we’ve observed in the wild which allow a D2C brand to successfully engage consumers, disrupt incumbents, and change the world. In the lead up to ShopTalk March 3 in Las Vegas, we’ll review them here.

The best direct-to-consumer companies incorporate many of these models in parallel. The worst raise venture capital financing and buy their way to market share at a loss, only to discover at scale that customers lack a reason to return and buy again. If a few shoppers were fooled at the start, they quickly lose incentive to return, and (with one exception we’ll discuss below) one-time, single-purchase customers are the death knell for D2C brands.

It is possible, with a single KPI, to measure ongoing the value of a D2C company’s core values, brand authenticity, social impact, product differentiation, and operational efficiency combined. That metric is customer equity, defined as the past, present, and future profit generated from the brand’s customer base. It is effectively LCV (Lifetime Customer Value) — also known as LTV (Lifetime Value) — but calculated on profit rather than revenue.

Customer equity is hard to measure, as it requires that every variable revenue and cost dollar associated with a customer relationship is properly tracked and allocated over all time. When instrumented correctly though, customer equity is a powerful holistic metric that reflects everything from acquisition and retention marketing costs to customer RFM (recency, frequency, and monetary value); product gross margins to the variable costs of doorstep delivery.

If customer equity is the metric then customer experience is the driver — from first contact to the most recent shopper touch or transaction.

If customer equity is the metric then customer experience is the driver — from first contact to the most recent shopper touch or transaction. Good brands track customer experience through the acquisition marketing funnel, customer service calls, repeat purchase behavior, product returns, and retention campaign engagement. Great D2C brands view their entire existential purpose through the lens of lifetime customer experience, measured as customer equity.

Great D2C brands view their entire existential purpose through the lens of lifetime customer experience, measured as customer equity.

Here we go! Let’s walk through the D2C models offering brands a platform to thrive — by giving consumers a reason to care.

1. Eliminate Muda

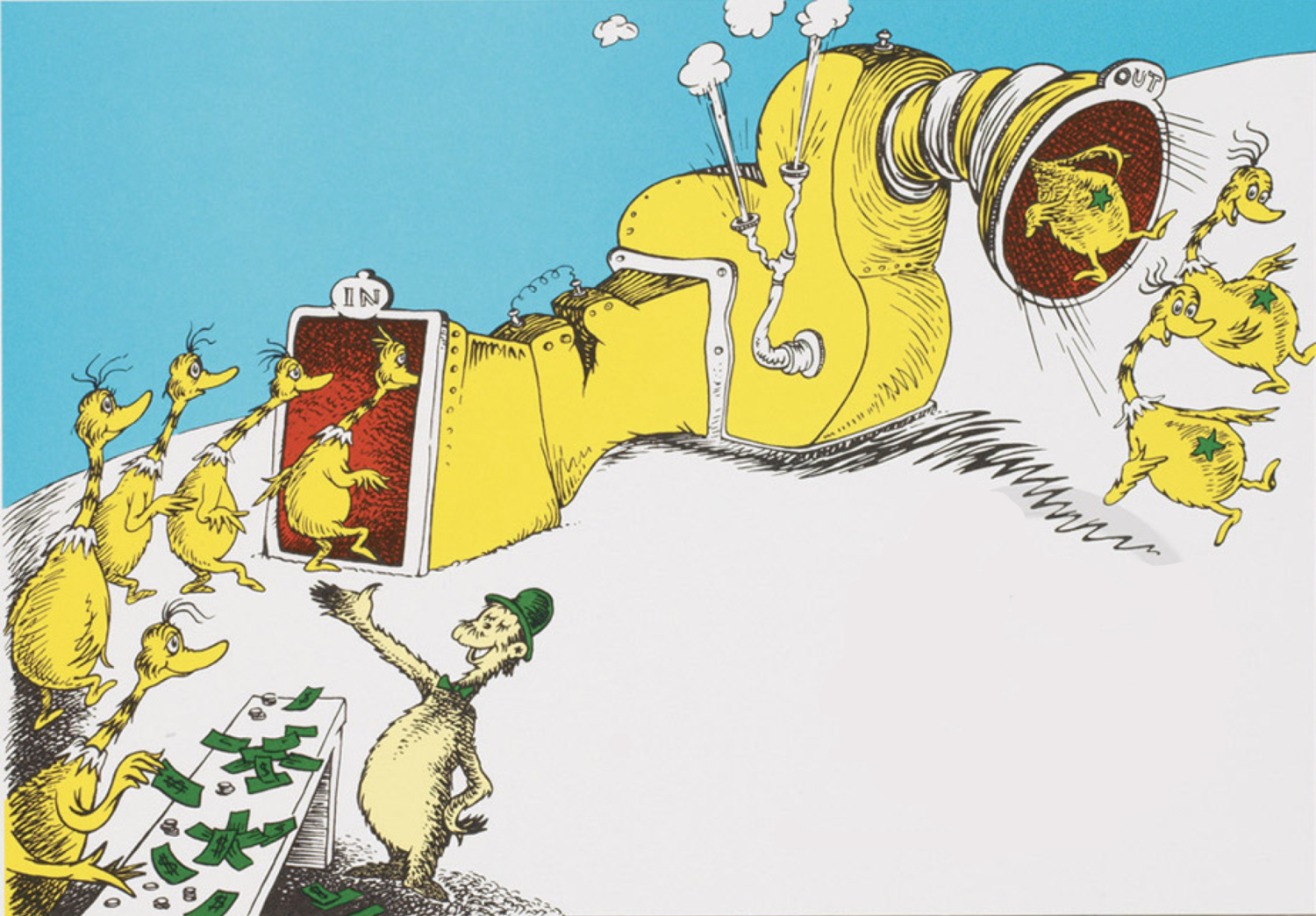

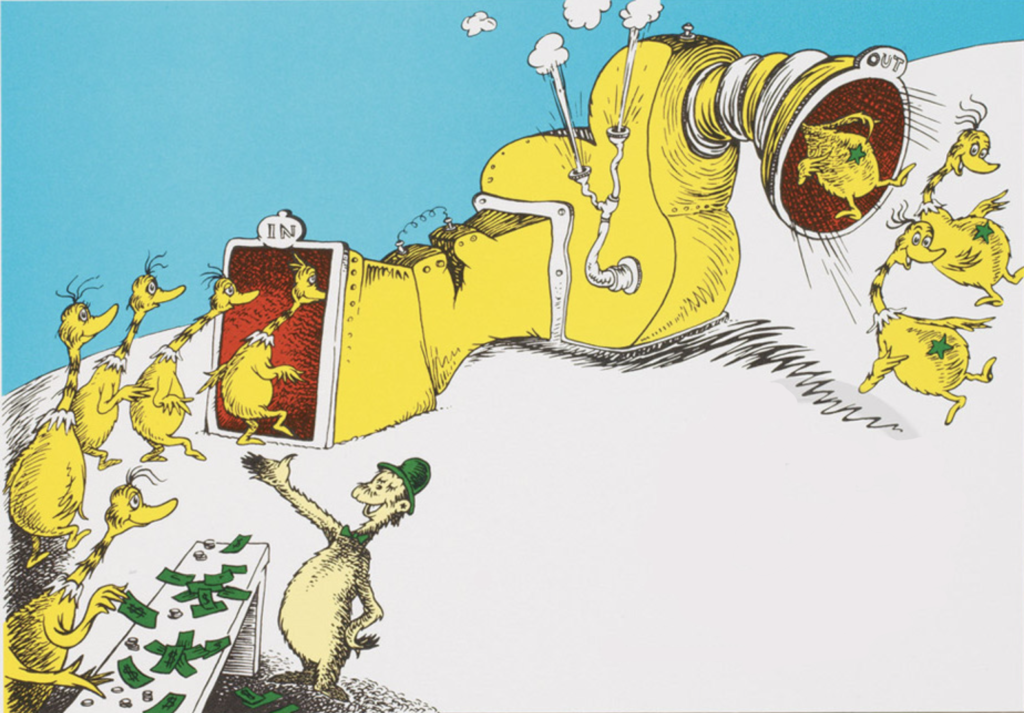

Let’s start with the obvious, namely traditional categories dominated by middle-men and monopolies. Here D2C brands (Casper, Warby Parker) capitalize on the waste of unnecessarily complex product lines and value chains (Sealy in mattresses) or monopolist control (Luxottica in eyewear) to undercut inflated margins and prices at comparable product quality. Brands can apply lean process thinking (first formalized at Toyota) to reengineer a category and pass those savings on to the end customer. But there’s a catch. If efficiency alone is your competitive mantel, you’re in a never ending race to drive down costs. As soon as Purple, Tuft and Needle and Amazon put mattresses in a box and started bidding on keywords, Casper’s original margin advantage was neutralized. They won the race to dominance (at least for now) based on speed to market and massive brand advertising campaigns. So much for margin advantage.

2. Build a Better Mousetrap

In contrast to the marketplace giants (we’re looking at you Amazon and Alibaba), runaway D2C brands bring new and disruptive products to market. There is no substitute for innovation here. The product advantage may lie in its simplicity, usability, nutritional value, battery life, machine washability or 17 zippered compartments — but it offers something new that I could not buy before, whether I knew I needed it or not. AWAY is a great growth-stage example of brand that combines 1 (competitive price point) and 2 (technical features) to disrupt the incumbent luggage brands. How do you know you’ve built a technically compelling product? Start with a long form PDP (product detail page) and fill it with video, photography, and technical content detailing the advantages of your design, manufacturing, and vision.Can’t muster the creative and content to fill the page? That’s a problem.

3. Sell Social Impact

Successful brands reinvent entire categories around social causes; social justice, human and more specifically workers’ rights, political alignment, environmental sustainability, radical transparency, fair trade, education or local artistry. Unlike the price disruptors described above, these companies sell at the prevailing (incumbent) price point, but reinvest their direct efficiency gains to the cause central to the brand narrative. This in turn helps drive consumer awareness and adoption, reducing acquisition and retention marketing costs — one of the most common places where D2C brands end up upside down. The fastest-growing D2C brands like Allbirds, Seattle’s own TomBoyX, and Cotopaxi combine 1, 2, and 3 to create a self-funding viral growth engine. Be warned future-Jessica Alba, that talking the talk without walking the walk here is a sure fire way to earn the wrath of the consumer.

Next Up

Check out models 4-6 in our next episode, now live!