There’s a new twist to the revolution happening in retail, and direct-to-consumer brands are driving the change by taking a page directly from Amazon’s playbook. It has profound implications for urban landscapes as consumer buying behavior continues to shift from large format stores to showrooms, online commerce and doorstep delivery.

In September we wrote about how, with the help of a warehouse network platform, TOMS utilizes pop-up warehouses to stage goods for sale through pop-up brick and mortar stores. Now there’s news that this dynamic, distributed inventory model is mainstreaming as brands and retailers look for creative and disruptive ways to better serve the consumer at the residential doorstep.

3PLs like Geodis and Prologis have been around for years and they aren’t going anywhere. Logistics Management tracks the largest lessors of logistics warehousing space nationally, and notes that in 2018 e-commerce players (33 leases) and third-party logistics (3PL) service providers (23 leases) led the way this year, with 56 total leases signed for facilities that mainly handle distribution for goods purchased online.

What’s needed now is the next layer of the network — the outermost ring that closes the gap between regional warehouse and the consumer doorstep.

What’s the big idea?

So what is new and different here? It’s that traditional fulfillment and delivery infrastructure, comprised of large-format suburban warehouses, is ill-prepared and ill-suited for the hyperelastic last mile needs of D2C commerce — and alone, cannot meet the convenience and customer service expectations of our end-customers.

What’s needed now is the next layer of the network — the outermost ring that closes the gap between regional warehouse and the consumer doorstep. Progressive retailers like Zumiez already use their regional stores to aid in ecommerce fulfillment, but new players are making this hyperlocal distribution possible for every merchant.

…traditional fulfillment and delivery infrastructure, comprised of large-format suburban warehouses, is ill-prepared and ill-suited for the hyperelastic last mile needs of D2C commerce

As physical retail stores undergo the transformation from large format inventory-focus to small format experience-focus, so too are distribution and fulfillment nodes. This next generation of ecommerce inventory sortation and staging centers is like a value-chain hack, repurposing locations originally built for other uses. For that matter the center may be nothing more than a tent pitched on bare earth — a vacant lot — with shelter and security in place only for the temporary (holiday) window during which goods must flow and capacity is needed.

10 Service Providers Helping D2C Brands Extend Reach and Improve Customer Experience

In the era of Uber and Airbnb, it’s no surprise that an entire venture-backed ecosystem is springing up to enable this hyper-local, hyper-elastic fulfillment and delivery capability.

How can you leverage these providers in 2019 to provide more convenience and a better doorstep experience for shoppers? Here’s a partial (and growing) list of the vendors enabling hyperelastic fulfillment capability for retailers and brands in the North American market and beyond:

Hyperelastic Warehousing

These providers help merchants capitalize on short-term fulfillment centers and distribution centers, including those spaces not originally built for this purpose.

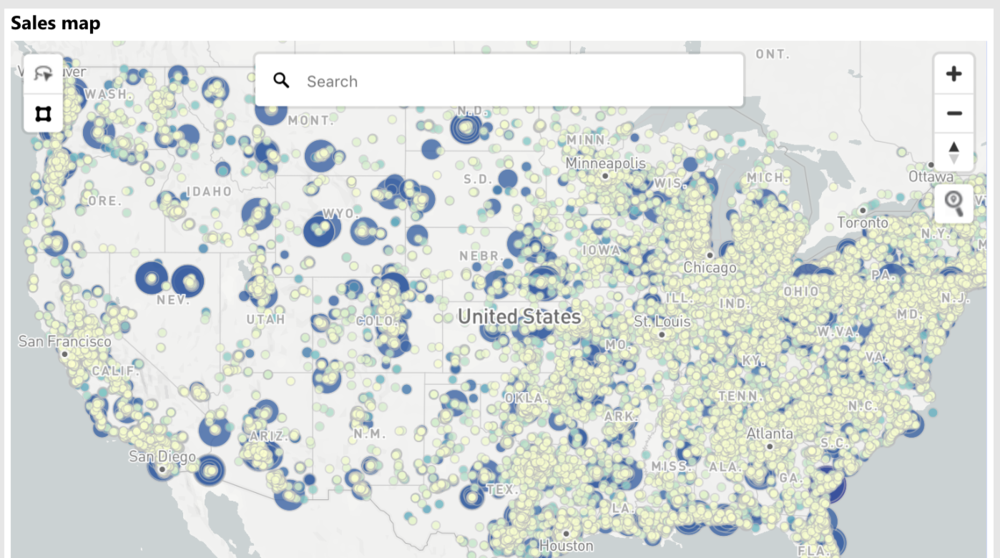

Flexe – Based in Seattle, and backed by $19M from Redpoint, FLEXE connects you to warehouse capacity when, where, and how you need it.

Flowspace – Based in LA and seed-funded by Moment Ventures, Flowspace provides on-demand warehousing for business.

Stord – Based in Atlanta and seed-funded by Dynamo and Susa Ventures, Stord offers world-class warehousing & distribution for modern shippers.

Warehouse Exchange – Founded by supply chain veteran Jonathan Rosenthal, Warehouse Exchange is an automated warehousing marketplace matching buyers and sellers of space in real-time. It appears the company is bootstrapped, or has not yet announced outside financing.

Delivery Logistics and “Smart Routing”

These providers tend to fall into two categories — software for merchants with existing delivery capability (people and trucks), and those that need delivery infrastructure (people and trucks) from a partner or through crowdsourcing.

Bringg – Based in Chicago and backed by $27M from SalesForce Ventures, Bringg is a delivery logistics technology platform for enterprises, serving customers in more than 50 countries.

OnFleet – Based in San Francisco and seed-round funded, Onfleet is a B2B software company that specializes in last-mile delivery logistics. Onfleet powers millions of deliveries every month for thousands of businesses in around the world. Onfleet’s customers range from food & beverage delivery services to laundry & dry cleaning, prescription pharmaceutical, and flower and retail delivery businesses.

Last-Mile Delivery

Deliv – Armed with $80M in venture capital, silicon valley-based Deliv is a crowdsourced same-day delivery service for large national multichannel retailers.

Dropoff – Based in Austin and funded with $17M from Greycroft and Fulcrum, Dropoff is re-inventing on-demand, same-day delivery for business, with our highly-rated service and proprietary logistics technology.

Shipsi – Based in Venice, CA, Shipsi is seed-funded by Stage Venture Partners and empowers any retailer with the ability to offer an easy “instant shipping” option on their checkout page—without worrying about logistics. We use existing infrastructure and last-mile delivery networks to help your customers order now AND get it now.

Darkstore – Based in San Francisco and seed-funded by PivotNorth Capital, Darkstore offers a platform for same-day delivery for e-commerce sites.

Contact us at SoundCommerce to add hyperelastic fulfillment capability to your 2019 customer experience and growth strategy.